It’s a common question for new business owners to ask when they just want to ensure that they are doing things right: “What is a reasonable profit margin for a small business?”

A profit margin is one of the many financial metrics used to evaluate a business, either for investment purposes, or for a business of your own.

A profit margin assesses a business’s ability to generate earnings relative to its revenue, balance sheet assets, operating costs and shareholders’ equity over time.

The 3 Types of Profit Margin

Gross margin measures the return on sales of your goods and service. Operating margin subtracts operating expenses from gross margin, leaving you with what you have left after expenses are paid.

The gross margin is intended to track the relationship between the product prices and the cost it takes to make or supply the product. The operating margin is designed to to track the impact of supporting costs, such as general and administrative costs.

The net margin is expressed as how much profit is retained from revenue. When someone talks about profit margin, this is typically what they mean. This is net income of the company described as a percentage.

Net Income / Revenue = Net Margin

Hedging Your Business Against Inflation

If you are a small business owner, or an investor considering a new business, it is important to hedge your business against inflation, to prevent inflation from essentially decreasing profits year-by-year.

It is vital to hedge against inflation, because the companies that do this focus on the long-term, while companies with a short-term vision on profit margin are bound to fail.

Industry

The answer is, it depends on your industry. Compare yourself with top companies in your industry, and see how close your profit margin is to theirs.

If your profit margin is much higher, then perhaps you aren’t devoting enough money back into the business. There are many expenses that a business owner should cover in order to produce longevity within the company.

Where Your Sales Should Be Going

You shouldn’t try and cut expenses as much as possible. Cut out the ones that aren’t doing you any good, but there are some expenses that are vital to the long-term growth of the business.

Research & Development

Reseearch & Development includes actions that companies take to learn to create new products and services. They use this budget for engineering or scientific experiments, to figure out how to either:

- Improve a product they already have

- Conduct a service more efficiently

- Expand into a new territory

How do companies like Apple, Amazon, and Google stay at the top? They have dominated the early 21st century, and show no signs of stopping. Some say ingenuity, some say innovation, but how do they innovate so much? How do they show so much ingenuity?

Here we have a list on the top Research and Development spenders in 2018.

Apple is #7, Google is #2, Amazon is #1, worldwide. They spend more on research than any other company in the world, and guess who is known for innovating?

Marketing Research

“Market research may be regarded as the bridge between developmental research and sales.” -Philip Fisher, Common Stocks and Uncommon Profits

Marketing is more important today than it has ever been, with competition around every corner in almost every industry. This isn’t to mention the internet, which dominates the marketing world. People fight for views, product links, and shout-outs all over social media, Google, and other search engines.

JP Morgan, Disney, and General Motors are among the top companies for marketing research, and they are at the top of their fields! JP Morgan is widely considered the greatest bank, and the best investment in the financial field, Disney is “on their way to conquering the world”, and General Motors is a world-renowned motor company.

Why would they continue to spend so much on marketing, when they already have a good name?

Competition. If you don’t invest in marketing research, then your competition will eat you alive. In this fast-pace world of business, one mis-step can leave you tumbling and scraping on the edge of bankruptcy. One bad product, one failed promotion, all of these can have drastic consequences on your company, even at smaller levels.

Even on a smaller scale, it is important to invest in marketing research. In order to grow, you need to efficiently market your product.

Sales Training

Why should you invest in sales training for yourself and your employees?

- 96% of decision makers claim that they’re more likely to consider a brand’s products or services if sales professionals have a clear understanding of the decision maker’s needs.

- 40% of clients rank trust as the #1 factor in closing a deal, above price and rate of return, and 51% of decision maker rank trust as the top factor that is desired in a salesperson.

- Millennials are quicker to implement new strategies like marketing and sales orchestration, which is contributing to their success as the highest-performing age group.

- 73% of sales professionals use sales technology to close more deals. Top sales performers see networking platforms as “very important” to help close deals at a 51% higher rate than their peers.

You need sales, no matter what business you’re running. A florist shop employee needs sales training. A mechanic needs sales training. An author needs sales training. Why?

In Robert Kiyosaki’s book, Rich Dad, Poor Dad, he described a time when he was being interviewed by an amazing journalist, with a great gift in writing, and a master’s degree in literature.

Robert Kiyosaki never went to college, and had no prior experience in literature. However, he is a bestselling author. When he talked to the journalist about this, she tried to argue that she didn’t need sales training because she was a professional author and wrote a much better book than he did.

Robert pointed to his book, sitting there on the table. He told her, “It says best-selling author. Not best ‘writing’ author. I am a terrible writer. You are a great writer. I received sales training. You have a masters degree. Put them together and you get a ‘best-selling author’ and a ‘best-writing author’.

Companies like Oracle and Apple spend millions of dollars on sales training, and US companies in total spend over $15B on sales training.

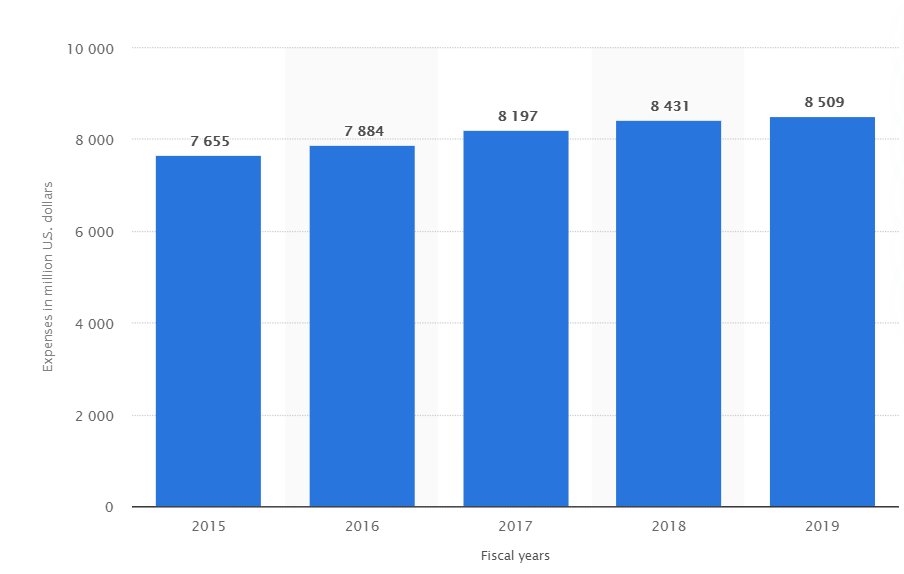

The chart above represents Oracle’s sales training budget from 2015-2019, and it has grown consistently every year, along with its profits.

It is not only important to leave aside some money for sales training, but increase the amount invested as your company grows as well. When your budget becomes stagnant, so will your business.

Why A Small Business Should Increase Profit Margin

If a business already has a good profit margin, why does it need to grow? You’re making more than enough money at the time, right?

Correct. You’re making more than enough money… at the time.

A lot of companies begin with good profit margins, but overtime, inflation causes the price of their expenses to go up, and when your profit margin remains stagnant or decreases, eventually the expenses will outweigh the profit.

This is why you should focus on growing the profit margin overtime, with new innovation and ingenuity at your small business.

What is a Reasonable Profit Margin for a Small Business?

This is what you guys have been waiting for, right? “What is a reasonable profit margin for a small business?”

When finding a reasonable profit margin for your small business, ensure you go through the steps of

- Evaluate your competitors and what their profit margin is

- Devote enough resources to the different fields of expanding your business

- Devote time and money towards innovation

Once you’ve evaluated your industry, let’s move on to the big players. Obviously, small business are playing on a smaller scale, but the large companies are who you should truly look up to as role-models. The only reason they are so successful is because of hard work, and taking the right steps towards success.

As a general rule of thumb, a 7-8% profit margin is considered average in most businesses. Some industries offer a higher average profit margin, some are lower.

A lower profit margin isn’t always bad, if you are going above and beyond to invest back into the business. Investing back into the business can help you grow more efficiently, just ensure that those investments are producing more cash flow so that you can hold onto more cash or cash equivalents for any unexpected expense.