This MFA Financial stock analysis will be conducted through the following comparisons and valuations to determine if it is a good buy or not:

- Industry

- Annual Report

- Balance Sheet Strength

- Income Statement

- Price & Dividend History

- Comparison to Industry

- Valuation

- Forbearance

- Overall Analysis

MFA Financial is an internally managed Real Estate Investment Trust (REIT) with the objective of delivering shareholder value through the generation of distributable income and through asset performance linked to residential mortgage credit fundamentals. MFA Financial selectively invests, on a leveraged basis, in residential mortgage assets with a focus on credit analysis, projected prepayment rates, interest rate sensitivity and expected return.

Mortgage REIT Industry

The mortgage REIT industry is highly leveraged, as stated in the introduction to MFA Financial. This means that they use either equity or debt to obtain a higher return overtime.

Is it a risky strategy? Maybe, but it is also relatively safe. Leveraging means that MFA Financial has a lot of debt, but also has consistent profits to pay it off, as do all of the other mortgage REITs.

Think how Grant Cardone got his money. Think how Donald Trump got his money. They leveraged other peoples money (debt) to obtain higher-valued properties and generate higher returns.

Now the difference between mortgage REITs and your typical REIT, (Realty Income comes to mind) is that mortgage REITs buy mortgages, whereas 90% of REITs buy rental properties.

Mortgage REITs earn income from the interest earned through mortgages and other securities.

MFA Financial Annual Report

This will be a summary of MFA Financial’s annual report. To see the report for yourself, go to the SEC Filing.

There are 5 primary factors when analyzing a mortgage REITs annual report:

- 1. Business

- 1A. Risk Factors

- Selected Financial Data

- Management’s Discussion and Analysis of the Financial Condition

Note to bear in mind: This annual report was completed before the COVID-19 pandemic, and does not represent the state of the company currently, only how it was in the past and in history. It should give you some insight into the company, the management, and the industry.

Business

MFA Financial invests in residential mortgage assets by leveraging debt and equity to increase the amount of assets they have.

“Our financing strategy is designed to increase the size of our investment portfolio by borrowing against a substantial portion of the market value of the assets in our portfolio.”

The higher the value of their portfolio, the more cash flow that comes to investors, hence why they use debt.

Competition

“We believe that our principal competitors in the business of acquiring and holding residential mortgage assets of the types in which we invest are financial institutions, such as banks, specialty finance companies, insurance companies, institutional investors, including mutual funds and pension funds, hedge funds and other mortgage REITs, as well as the U.S. Federal Reserve (or Federal Reserve) as part of its monetary policy activities. Some of these entities may not be subject to the same regulatory constraints (i.e., REIT compliance or maintaining an exemption under the Investment Company Act) as we are. In addition, many of these entities have greater financial resources and access to capital than we have. The existence of these entities, as well as the possibility of additional entities forming in the future, may increase the competition for the acquisition of residential mortgage assets, resulting in higher prices and lower yields on such assets.”

In shorter terms, MFA’s competition ranges from other REITs engaged in residential mortgages to any large investor that isn’t enforced by the same regulations and standards that MFA is.

1A. Risk Factors

Residential Whole Loans represents 37.7% of their portfolio as of their latest annual report filing. This puts them at risk of loan defaults, as any mortgage REIT is at risk of.

“Credit spreads, which at times can be very volatile and react to various macro-economic events or conditions, measure the additional yield demanded on securities by the market based on their perceived credit relative to a specific benchmark. Fixed rate securities are valued based on a market credit spread over the rate payable on fixed rate U.S. Treasuries of like maturity. Floating rate securities are generally valued based on a market credit spread over LIBOR. Excessive supply of these securities combined with reduced demand will generally cause the market to require a higher yield on these securities, resulting in the use of a higher, or “wider,” spread over the benchmark rate to value such securities.”

In shorter terms, credit spreads can cause the value of MFA’s portfolio to decrease, which again, is something that all mortgage REITs are at risk for.

MFA Financial has a significant investment in California, Florida, New Jersey, New York, and Maryland. Since these were some of the primary places affected by the coronavirus, a lot of revenue was lost. The sooner these places begin to reopen, the sooner MFA Financial can recover.

“The federal conservatorship of Fannie Mae and Freddie Mac and related efforts, along with any changes in laws and regulations affecting the relationship between Fannie Mae and Freddie Mac and the U.S. Government, may materially adversely affect our business.”

MFA Financial relies heavily on lenders like Fannie Mae and Freddie Mac, and if any law or regulation changed between the lenders and the government, it would have an effect on the MFA’s investments.

Luckily, since the 2008 financial crisis, (which MFA Financial performed fine in) the government has stepped up and offered more support to lenders like Fannie Mae and Freddie Mac.

And possibly their biggest risk:

Leverage.

If the company were to ever become overleveraged, then they are at risk of losing everything due to lack of capital, and being overcome my debt. This is what the primary risk of mortgage REITs are, which is why they normally perform well in bull markets, but suffer in housing crashes.

Selected Financial Data

MFA Financial has maintained a dividend since 2005, without cutting it.

MFA Financial has gradually increased the amount of interest expenses since 2015, while keeping a stagnant amount of interest gained.

Management’s Discussion and Analysis of the Financial Condition

This is a representation of the diversification that MFA holds in their investments.

“At December 31, 2018, we had total assets of approximately $12.4 billion, of which $6.5 billion, or 52.4%, represents investments in residential mortgage securities. At such date, our portfolio includes $2.7 billion of Agency MBS, $3.3 billion of Non-Agency MBS and $492.8 million of CRT securities. Non-Agency MBS is comprised of $1.9 billion of Legacy Non-Agency MBS and $1.4 billion of RPL/NPL MBS.”

“The results of our business operations are affected by a number of factors, many of which are beyond our control, and primarily depend on, among other things, the level of our net interest income, the market value of our assets, which is driven by numerous factors, including the supply and demand for residential mortgage assets in the marketplace, the terms and availability of adequate financing, general economic and real estate conditions (both on a national and local level), the impact of government actions in the real estate and mortgage sector, and the credit performance of our credit sensitive residential mortgage assets.”

In shorter terms, this describes how reliant MFA Financial is on both the market and government. The downside: Mortgage REITs are heavily reliant on sources outside of their control. Upside: They are more likely to receive assistance from either lenders, or the Federal Reserve.

“Our investments in residential mortgage assets, particularly investments in residential mortgage loans and Non-Agency MBS, expose us to credit risk, generally meaning that we are subject to credit losses due to the risk of delinquency, default and foreclosure on the underlying real estate collateral.”

MFA Financial Balance Sheet & Income Statement

The financial statements are essential to determining the financial strength of the company.

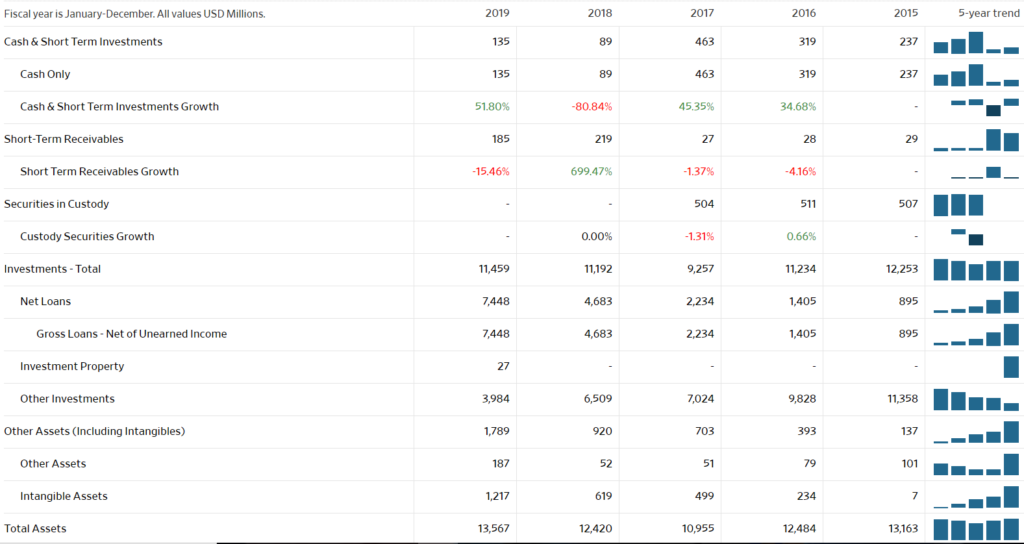

As viewed from the balance sheet, MFA Financial has a large slump in cash & cash equivalents in a 5 year period, but has a grown their cash by 50% since 2018.

MFA Financial’s short-term receivables are up massively in the last 5 years, meaning that there is a lot of money that is owed to them within this year.

While MFA Financial’s cash has slumped, so has their debt. MFA has eliminated almost half of their long-term debt! This is certainly a good sign for management. A lot of mortgage REITs continuously take on as much debt as they can to please investors, but it appears that MFA’s management has a different vision – longevity.

In correlation with the cash slump, MFA Financial’s short-term debt has fallen slightly in the last five years, with a large jump since 2018 – going along with the large jump in cash & cash equivalents.

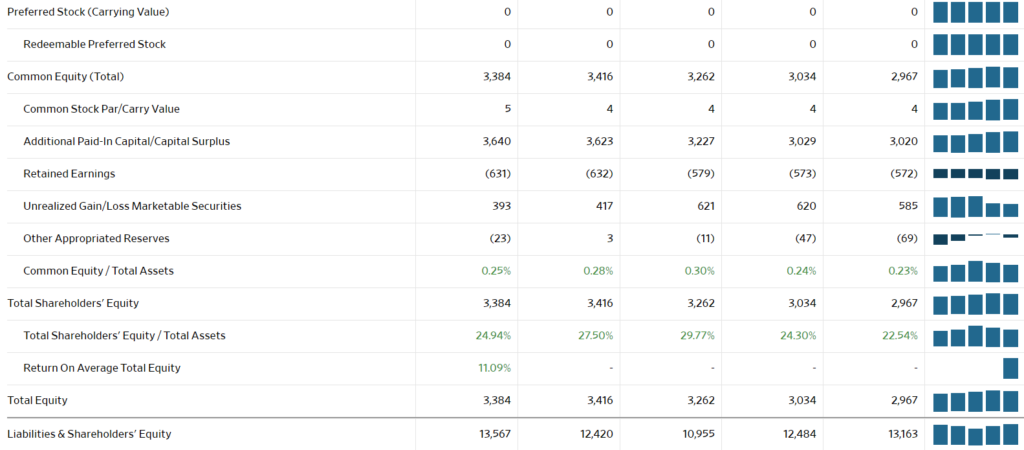

The company’s equity has risen at an average of 2.5% annually over the last five years.

MFA Financial’s free cash flow has been inconsistent, as has all of the mortgage REIT market. 2015 is on the left, the farther right the more recent.

So after a fall in cash flow in 2018, 2019 saw a dramatic increase of 45%. With this increase in free cash flow, this explains why the balance sheet looks much stronger in 2020 compared to 2018.

MFA Financial’s revenue has increased exponentially in the last 5 years, with consistent revenue growth over the last four. Total income has almost doubled since 2015. Operating income is up about 22% in the same span, and unusual expense is down drastically.

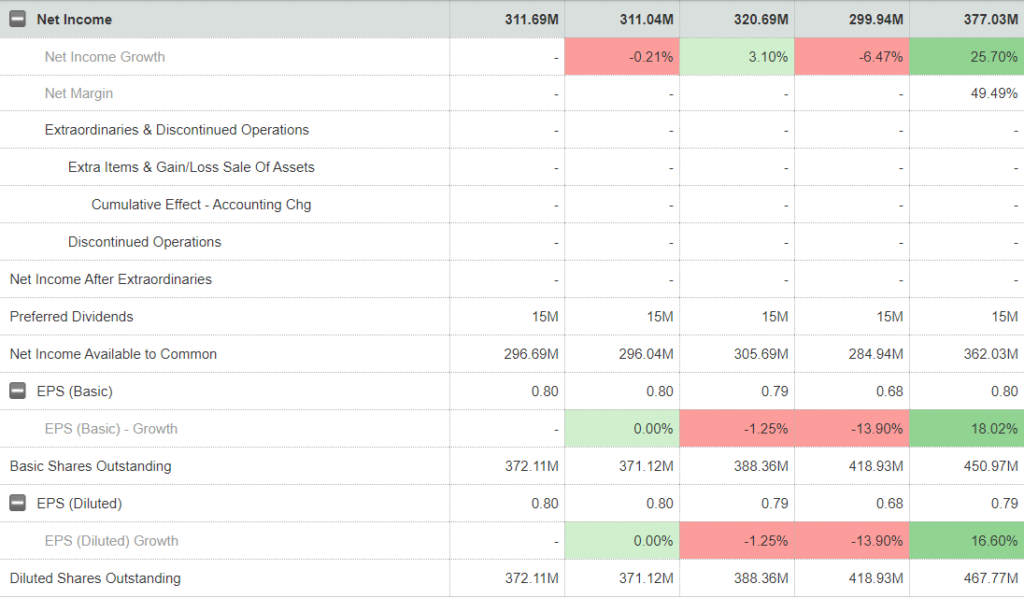

Net income is also up about 22% from the view of the chart, and EPS, while inconsistent, has improved overtime.

MFA Financial Price & Dividend History

MFA Financial maintained a $6-$8 price range for over 15 years, until the COVID-19 pandemic hit. As you can see, the price plunged, making it an amazing value opportunity… if it can survive.

MFA Financial has paid a consistent dividend since 2005, but that will stop now. With a 50% yield, there is absolutely no way that MFA will be able to maintain it.

MFA Financial Comparison to Industry

When comparing to the industry, it is good to compare:

- Financial Statements

- Side-by-Side Comparisons

- Company Strength

We will be comparing MFA to NLY, TWO, and AGNC.

Revenue:

NLY’s revenue has slightly increased over the five-year period.

TWO’s revenue has increased dramatically, from 732M to 1.9B.

AGNC’S revenue fell dramatically during the five-year period.

Net Income:

NLY’s net income has fallen to -2.16B, an extremely dramatic decrease in net income over the last five years.

TWO’s net income has fallen dramatically in the last five years, though not as much as the other two companies.

AGNC’s net income has fallen with the revenue. That is the biggest decrease of the four, and does not look good for the company.

MFA Financial is the clear winner in terms of net income, because of instead of a dramatic decrease, theirs has actually increased.

Cash & Cash Equivalents:

Cash is one of the most important factors for mortgage REITs, because any asset that does not fall under this category is typically more difficult to liquidate.

NLY’s cash reserves has been wildly inconsistent, amounting to a basically break-even amount over the course of five years.

In those same five years, TWO has risen from $732M to $1.9B.

In those five years, AGNC has risen at a similar amount to TWO

If you’re looking for cash consistency, MFA Financial is the winner. If you’re looking for overall five year growth, then MFA loses to the competition.

Debt:

Debt is expected to be significantly higher than anything else in the mortgage REIT industry. However, the lower the leverage, the more power a company has to survive a financial crisis.

NLY has almost doubled its debt since 2015, but has also almost doubled its assets as well to match.

TWO followed a similar path, except it tripled its debt since 2015, as well as the assets.

AGNC has slightly more debt versus 2015, but has almost doubled its assets.

Winner: The winner depends on what you personally look for. AGNC has slightly more debt, but doubled its assets. MFA has slightly more assets, but cut its debt in half. The winner could be whichever appeals to you. AGNC has more growth than before by this standard, and MFA has more stability than it did before.

MFA Financial Valuation

| Market Cap (intraday) 5 | 715.92M | 3.46B | 3.32B | 3.23B | 3.28B |

| Enterprise Value 3 | N/A | N/A | N/A | N/A | N/A |

| Trailing P/E | 2.00 | 10.93 | 10.51 | 10.72 | 10.69 |

| Forward P/E 1 | 2.04 | 10.36 | 10.22 | 12.32 | 11.53 |

| PEG Ratio (5 yr expected) 1 | N/A | N/A | N/A | N/A | N/A |

| Price/Sales (ttm) | 1.72 | 9.02 | 8.67 | 8.71 | 8.81 |

| Price/Book (mrq) | 0.21 | 1.02 | 0.98 | 0.95 | 0.96 |

This is the most attractive thing about MFA Financial.

IF it survives the closed economy of the COVID-19 pandemic, it will fire back! A price/book ratio of 0.21? That’s almost 1/5 of what it normally averages! All of the valuations indicate that MFA is severely undervalued. But, it is a risky play, hence why it is undervalued.

Forbearance

This is what makes MFA risky as a mid-term play.

What initially sent MFA Financial plunging was its inability to meet the margin call when they received an exceptional amount of requests from financing counterparties, and MFA lacked the liquidity to pay the mortgages.

MFA has currently gone through two forbearances, trying to produce liquidity in order to satisfy the margin calls.

If MFA Financial fails to satisfy the margin calls and does not meet the forbearance, then the financing companies have the right to seize assets.

Overall Analysis

MFA Financial comes down to one thing: Forbearance. If they can survive this COVID-19 pandemic, they will rise back up.

This is when you as an investor needs to decide: Do you think it will survive?

After conducting this MFA Financial stock analysis, it is easy to see that it is definitely a high risk/high reward play, but it isn’t as high risk as your average pennystock. I would say MFA Financial has a better chance of rising back to its previous levels than most pennystocks. In terms of “best mortgage REIT”, I would say it is the best in terms of potential return for a COVID-19 comeback. Best in terms of strength? No.

Don’t sink your savings in it, but if you want the potential for a 500% return, sink a little bit in it.