15 Reasons Why Multifamily is the Best Investment for the Future

If you want to know why multifamily is the best investment for the long-term, you came to the right place. There are many different ways to invest: stocks, bonds, CD’s, single-family homes, retail, you name it, you can invest in it.

While most investments can prove to be decent through modest gains overtime, I’ll tell you why multifamily is the best investment.

- Cannot Be Easily Replaced

- Produces Positive Cash Flow

- Appreciation

- Leverage: How Money Multiplies

- Demographics

- Baby Boomers

- Millennials

- Affordability

- Flat Wages

- Performance

- Pressure on Price

- Debt Pay Down

- Tax Benefits

- Capital Gains

- New Tax Laws

- Control

Cannot Be Easily Replaced

“Rule Number 1: Never lose money. Rule Number 2: Don’t forget rule Number 1.” -Warren Buffett

If your goal is to safely invest your money in an appreciating asset that produces income for you every month, multi-family rental properties are an investment you may need to consider.

While your stock gains may be wiped out with a bankruptcy or market crash, all the apartments will still be there. People will still need a place to live, and people will pay the rent.

No company needs to pay you a dividend. No company needs to grow their stock price in order for their employees to survive. It would help, sure, but it isn’t needed.

People will need a place to rent. If someone moves out, someone will move in. Just find a good property in a good location.

Produces Positive Cash Flow

Cash flow is the lifeblood of a business. That is why many companies go bankrupt soon into an economic downturn. When they lack cash flow, they can’t pay their bills.

If you have more cash flow coming into your home, you have more power to pay your bills. That’s what real estate does. When you buy a piece of multifamily real estate, you will get a check every month for each unit that is occupied.

This not only increases safety in investment, but also increases scalability. Cash flow.

Appreciation

Real estate not only pays you monthly cash flow, but good properties naturally appreciate overtime, giving you more equity in the property. This means that you have more buying power for new potential properties, or you can sell your property for a higher price.

Real estate appreciates faster than most investments out there, and offers security and peace of mind.

Leverage: How Money Multiplies

If you invest $25,000 into stocks, you will get $25,000 worth of stock, unless you use margin, which is extremely risky and not recommended for anyone without a financial advisor. $25,000 worth at an average return of 7% will net you $1,750 in one year.

If you invest $25,000 into real estate, you can fairly easily get a down payment for a $125,000 property.

So with real estate, you are getting 4-5X the assets, meaning 4-5X the cash flow, and 4-5X the appreciation.

Is there risk? Of course! But you won’t be making the mortgage payment, a tenant will. You won’t be paying insurance and other fees, another tenant will. You will use the money you get from their rent to cover expenses, and net the profit.

Demographics

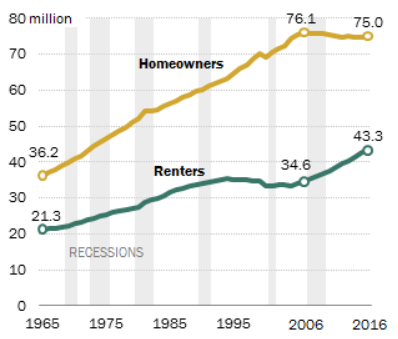

To begin, we will establish the demographics of homeowners versus renters.

There are still a lot more homeowners than renters for sure, but you have heard about multifamily investing in the past. There are even more renters now than there were then!

If we are thinking long-term, (which you should be if you plan to invest) it is easy to look at the graphs and see which is better to get into.

Should your business appeal more to homeowners, or to renters?

Homeownership has stagnated for a decade and a half, while the amount of renters has shot up more than anytime in history, and it is becoming a more popular way of living every year!

Baby Boomers

When you think of tenants, you would typically picture a millennial family, right? Well, they aren’t the only ones, aging baby boomers are far more likely to move into rentals in the future rather than buy a new home.

This is because many don’t want the burden of a 30-year mortgage, and would rather put their money towards other things.

This graph depicts the amount of baby boomers renting a home from 2007-2014.

This graph should also offer reassurance in the fact that baby boomer renters continued to grow through the Great Recession!

It may be hard to sell a home in a market downturn, but you can always find tenants if you have a good property, in a good location.

Millennials are Delaying the Home Purchase

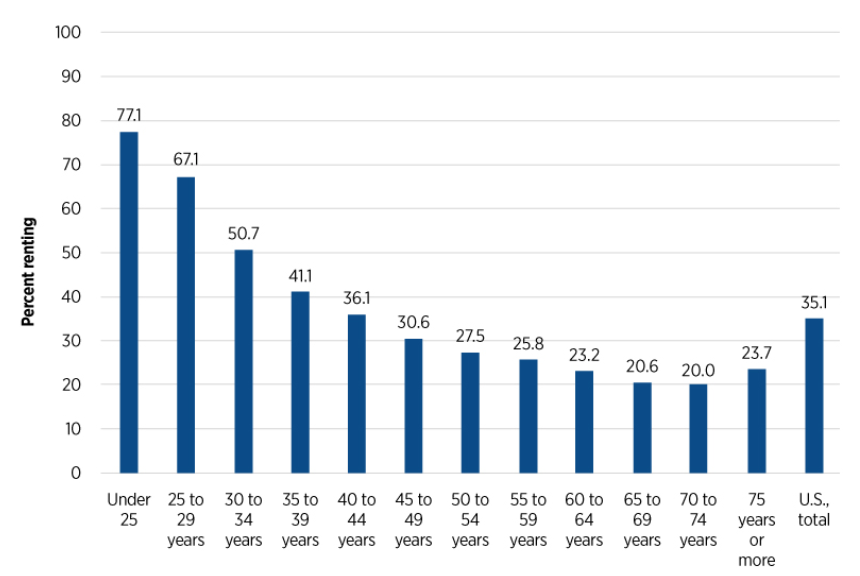

Previous generations generally had their kids in their late teens, or early 20’s. The millennials have changed that norm, with an average age of about 29 years old before they start a family.

This means that they will need a place to live from age 18-29, and typically a mortgage is very intimidating for young adults. They don’t see a need to lock into a 30-year mortgage when they are still figuring things out.

Over 50% of people under the age of 35 rent their house!

67% of people between 25-29 rent their house

Over 3/4 of people under 25 rent where they live!

You see where we’re getting at here? Millennials care about freedom to travel far more than previous generations, and rental properties give them the flexibility to do so.

Affordability

Affordability of home ownership continues to fall, as it is out of reach for many Americans.

Americans plagued by years of flat wages, no savings, and no credit will never be able to get a mortgage on a house. They will always look for a place to rent.

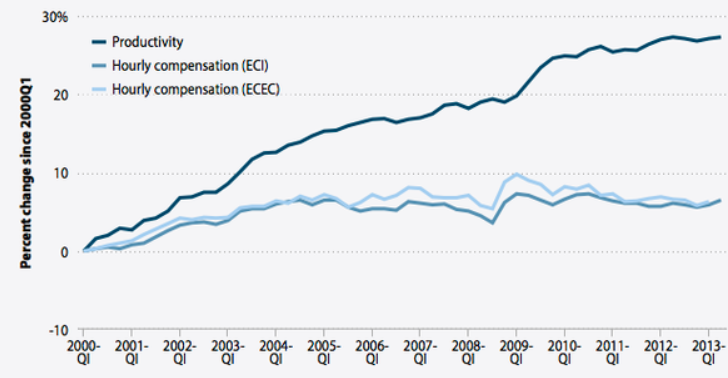

Flat Wages

Wages have been flat since the new century started, and continues to get worse as inflation becomes a heavier factor in hourly wages.

Most Americans working on an hourly wage cannot afford a mortgage along with everything else they have to juggle.

These workers will always be on the lookout for good places to rent, meaning that you will always have potential tenants.

Performance

Rental Properties overall have outperformed stocks, bonds, and cash throughout the 21st century.

The reason why real estate has historically produced higher returns is because of scalability through leverage and cash flow.

Multifamily real estate automatically gives you much higher cash flow than you would receive in stocks, allowing you to purchase more assets, allowing you more cash flow, and the process continues.

Combine this with the ability to leverage, and the buying power goes up 400-500%!

We can take it back even further if you want. Since 1870, in an analysis of 16 different countries, rental properties has historically had higher returns than any equity or bond.

Pressure on Price

Not only is it expensive to buy a house, but it is also expensive to build a house. Since it costs more now than ever to build an investment property, there is more pressure on price than there has ever been.

Debt Pay Down

The more doors you have on your property, the more cash flow you will receive. This helps with your debt.

Income – Expenses = Net Operating Income

If you get at least a decent deal, doesn’t even have to be good, just decent, your net operating income should be more than enough to pay down the debt without anything coming out of your pocket for the payment!

This is why methods of investing like the BRRR strategy really work, and it is why people can continue to expand their real estate portfolio. Their tenants are paying down the debt, not the owner.

Tax Benefits

All maintenance, repairs, expenses, and depreciation, are tax-deductible items. When tax-time comes, you will be saving a lot of money thanks to multifamily real estate investing.

Capital Gains

Properties held longer than one year are taxes at lower rates than normal income tax.

Once again, when tax-time comes, you will be saving a lot of money thanks to multifamily real estate investing.

Control

In the stock market, you have no control. In bonds, you have no control. You have the priority, but if the company goes bankrupt and has no money to pay bondholders, how do you get your money?

Meanwhile, multifamily real estate are real investments, with real tenants that need a real place to live. All of these things are necessities.

The markets rely on human emotion to move up and down. Your rental properties rely on YOU.

How to Create Wealth Investing in Real Estate – Book by Grant Cardone

The information in this article, minus graphs, was provided by the book by real estate mogul Grant Cardone, How to Create Wealth Investing in Real Estate.