30 Year Mortgage Versus 15 Year Mortgage | Rentals and Realtors

If any of you have been looking into personal finance for more than a day, you probably know who Dave Ramsey is. Dave Ramsey is the pinnacle of getting out of debt, and going from broke to average.

Dave Ramsey is a great advisor, but he’s wrong about 15-year mortgages.

30-Year Mortgage Versus 15-Year Mortgage

When making the case for a 30-year mortgage, oftentimes you will face scrutiny— because of the problems on the surface.

It is easy to see that a 15-year mortgage will give you:

- Lower interest rates

- Less interest to pay overall

- Home is yours in 15 years instead of 30.

- Build equity quicker

Those look like very valid reasons to side against the 30-year mortgage right? The truth is…

It depends.

It all depends on the interest rates. Once interest rates on a loan exceed a certain amount, at some point a 15 year mortgage would be a better option. However, we haven’t seen rates even come close to exceeding in over a decade.

The average person sees that they will save money, so they think paying their home off early is a good decision.

But a person that wants to make money will only see it as a way to lose money due to opportunity cost.

It’s obvious that I side with those who choose the 30-year mortgage, let me explain why:

Primary Benefits of a 30-Year Mortgage

- Flexibility

We all know that economic setbacks happen. We all know that many people lose their homes during a pandemic, or recession. We all know that the more flexiblity you have, the better chance you have of keeping your home.

Just because you took out a 30-year loan doesn’t mean you have to follow the payments. You will start off with a slightly higher interest rate, but you will always have the flexibility to pay as needed.

So while your neighbor has a 15-year mortgage, when both of you get laid-off as a results of the industry failing during a recession, or struggling during a recession, choosing a 30-year mortgage prior will give you a better chance of making it through.

Let’s compare the rates and payments:

Assuming a $100,000 household, we will compare a 30-year mortgage vs a 15-year mortgage:

Scenario 1: 30-Year Mortgage

- House Price: $100,000

- Fixed Interest Rate: 3.125%

- Length to Pay Off: 30 Years

- Monthly Payment: $428

- Amount of Interest Paid: $93,750

- Overall Amount Paid: $193,750

Scenario 2: 15-Year Mortgage

- House Price: $100,000

- Fixed Interest Rate: 2.750%

- Length to Pay Off: 15 Years

- Monthly Payment: $679

- Amount of Interest Paid: $41,250

- Overall Amount Paid: $141,250

As mentioned before, from the surface, it seems like the 15-year mortgage is the obvious answer. But there is something that you’re not considering:

- Opportunity Cost

For those of you who don’t know,

Opportunity cost is the cost of missing out on the next best alternative. Essentially, choosing one option over another may not cause you to lose money, but you lose opportunity cost.

For example, if you buy a stock that rises 5%, but the stock you were considering rose 10%, you just lost 5% in opportunity cost because you COULD HAVE invested in the stock that paid 10%, and made 5% more money.

The beauty of the 30-year mortgage is that:

You can make more money with the lower payments than paying off the interest.

According to the above interest rates from bankrate.com, you are saving $52,500 over a 30 year period.

What if I told you that you can make more money with the 30-year mortgage versus the 15-year?

You have low interest rates for both, but you are saving 0.375% with the 15-year loan.

WHAT-IF: You invested the money leftover from the monthly payments, into something that paid more than 0.375%? You can get savings accounts that pay a higher yield than that…

Investing in a low-risk dividend portfolio can produce annual income of about 4%. If you put your money there, it would be as if you had no interest rate at all!

THIS is why real estate moguls suggest a 30-year mortgage over 15 years. THIS is why most of the rich and wealthy suggest a 30-year mortgage over 15 years.

Because you can make more money investing the money leftover from smaller payments, and essentially cancel the interest. Instead of saving money with the 15-year mortgage like many believe, you are actually losing money through opportunity cost.

The last section of this article will explain the strategy of earning up to 4 TIMES the weath you would from paying off your house faster. It is a simple method using the leftover money from the lower payment.

The Dave Ramsey Point-of-View

Why does Dave Ramsey vouch for the 15-year mortgage if the 30-year is a better option?

Because most people lack the financial discpline to keep their leftover money in a quality investment for decades at a time.

That’s all there is to it. Obviously, if you can keep your money invested in an asset that pays you more than the interest you are paying, and you are comfortable with that, it would be vouched more. Most people lack the financial discline to do so, and would end up buying something they don’t need every month.

Chris Hogan says a 15-year mortgage is a better option because of “simple math.”

Simple math is great… but perhaps a little too simple.

Obviously from the surface it seems like you are saving money, but in reality, yo uare losing money by choosing the 30-year mortgage.

30-Year Mortgage Strategy | In-Depth

Now that we’ve established that a proper investment can make a 30-year mortgage worthwhile, let’s take a look at the specifics:

- Take a Fixed Interest Loan

- Find a Solid Investment.

- Allow the Interest to Compound

- Take a Fixed Interest Loan

This step is extremely important, because if you take anything other than this, your interest can fluctuate through the years, and who knows how high it can go? If you take the fixed rate, you know it can never change, and will always remain the amount it says when you first sign the loan. And with interest rates the way they are now, it is a great time to sign.

- Find a Solid Investment

This is a matter of personal preference. Stocks, real estate, REITs, anything that is a safe way to let your portfolio grow in value.

An example I will use will be dividend stocks. This is one of the safest way to expand your income. While it has a lower ceiling than real estate, it is an almost foolproof way to get rich.

Let’s take 5 of the best, long-term dividend growth stocks. These companies are vital to their industry and remain at the top of their class:

3M -3.83% $153.65

O – 5.45% $51.31

KO – 3.61% $46.78

MCD – 2.69% $185.89

ED – $82.67 3.7%

- 3M – $153.65 Yield: 3.83%

- Realty Income – $51.31 Yield: 5.45%

- Coca-Cola – $46.78 Yield: 3.61%

- McDonald’s – $185.89 Yield: 2.69%

- Consolidated Edison – $82.67 Yield: 3.7%

These 5 great companies have an average price of $104.06 per share.

They have an average yield of 3.86%. The dividend yield is the estimated one-year return of an investment in a stock-based only on the dividend payment. Essentially, whatever dividend the company pays that year, take the percentage from the share price and that is the yield.

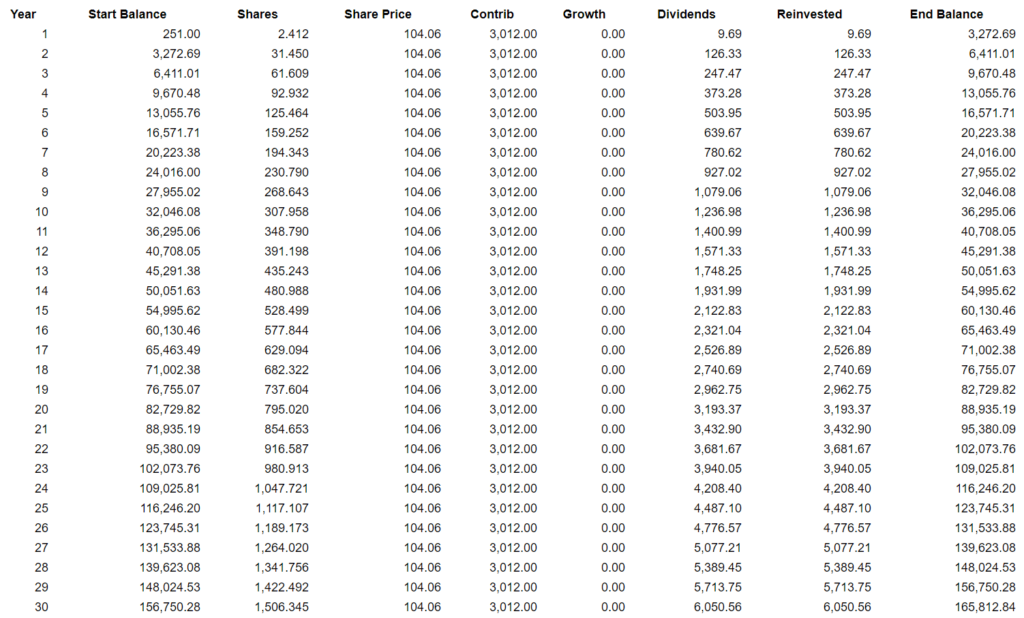

We can use the dividend reinvestment calculator to determine what our 30-year return would be if we reinvested all of the dividends we received, and ONLY invested the leftover money from the smaller payments.

Criteria:

- 15-Year Mortgage Payment ($679) – 30-Year Mortgage Payment ($428) = $251 Leftover Every Month

- Starting Balance Invested: $251

- Monthly Contributions: $251

- Expected Stock Growth: 0% (Extremely Conservative)

- Expected Dividend Growth: 0% (Extremely Conservative)

- Length of Investment: 30 Years

By this criteria that we ran in the calculator, we assumed there would be no growth whatsoever in any of the companies, which is unrealistic. McDonald’s will grow far and wide, 3M will continue to pummel its competitors, Realty Income will continue to expand its portoflio, and Coca-Cola will continue to dominate the consumer goods industry.

Assuming that you contribute your leftover mortgage money every month, and you reinvest all the dividends that these companies pay you, your portfolio will look like this throughout the course of 30 years:

When using a 15-year mortgage, you save $52,500 over a 30 year period. When using a 30-year mortgage, you lose $52,500 in interest, but you make $165,812.84 over a 30 year period.

This is the way that business-minded people think. Opportunity cost is extremely important.

If you want to learn how compound interest works, and how money multiplies like it showed in the calculator, I recommend reading The Snowball by Warren Buffet.