Is All Debt Bad? | Leveraging Good Debt and Bad Debt

Debt is viewed as a bad thing for most people. The majority of people have made it their goal to get completely out of debt and live a debt-free lifestyle. While this is good for those wanting to live an average life, for those looking for something more, debt is a tool that can be used for greater riches. So, is all debt bad? Let’s review.

Leverage Vocabulary

Leverage: Using borrowed capital, expecting the profits made to be greater than the interest payable.

Cash Flow: The total amount of money being transferred into and out of a business, especially as affecting liquidity.

Asset: Any resource that appreciates or pays you back.

Liability: Any resource that you pay for, and doesn’t pay your back.

Good Debt: Borrowing capital to purchase a quality asset.

Bad Debt: Borrowing capital to purchase a liability.

Leveraging Debt | Good Debt and Bad Debt

How did Donald Trump attain his real estate empire, worth billions?

Leverage.

How did Donald Bren attain his real estate empire, worth billions?

Leverage.

How did Sam Zell attain his real estate empire, worth billions?

Leverage.

These stories can continue on, and on, and on. Every real estate billionaire attained their wealth using leverage, and 90% of the wealthy attained their wealth through real estate, according to Andrew Carnegie— the 4th richest man of all time.

Leverage is the key to obtaining wealth. Here is an example of a debt-free real estate portfolio, and a leveraged real estate portfolio.

Here we will have two scenarios. In both scenarios, there will be a larger amount of money than you most likely have, this is to exaggerate the number differences. These calculations are correct, but leverage has an even larger effect on larger deals.

You will start out with $200,000 for both scenarios, and rents for each unit will be $750 a month.

Scenario 1: The Debt-Free Approach

(Prices and rents completely depend on your local market)

Investors that follow the Dave Ramsey principle are definitely one side of the argument, “is all debt bad?”

In this scenario, You’ve saved up $200,000 from your job and investments. You are ready to invest, and you decide to invest in a quadplex. A quadplex is a four-unit residential property.

The beauty of the debt-free approach, (no leverage involved) is peace of mind. Even if you don’t have tenants, you don’t have to worry about not paying for the mortgage. Here are the stats:

- Property Price: $200,000

- Number of Units: 4

- Each Unit Rent: $750

- Total Monthly Rent: $3,000

- Expenses: $1,000

- Monthly Cash Flow: $2,000

Using the debt-free approach, you start off making $2,000 monthly from a deal like this, assuming nothing major goes wrong in terms of repairs.

Scenario 2: The Leveraged Approach

These investors are the other side of the argument, “is all debt bad?” These are your Donald Trump’s, Sam Zell’s, and anyone who takes out a loan to get higher-valued properties.

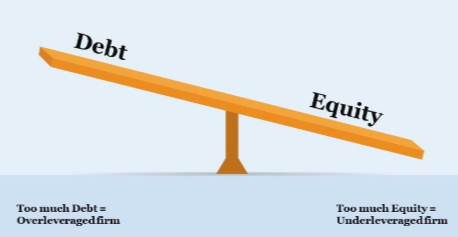

It’s a general rule of thumb that you can get at least 4x the amount of value when you leverage your properties. That is because safely leveraging your properties is a ratio of about 75:25 Debt-to-Equity. Meaning 75% debt, after you cover 25% of the down payment.

Since you only have to cover 25% of the down payment, that means you can afford an $800,000 multi-family property. You are more likely to get a discount with a large payment like this, but let’s assume it is the same rate as scenario one.

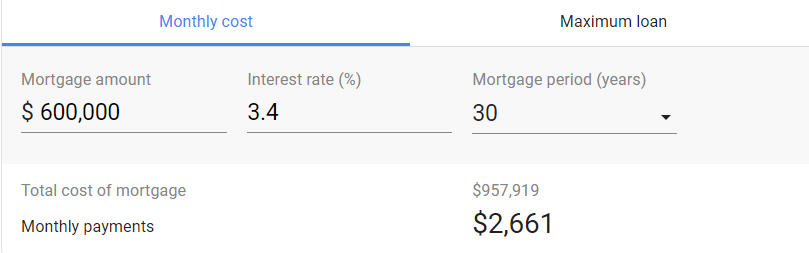

Assuming the average fixed interest rate of 3.4%, times the $600,000 loan that you are financing, you will owe $2,661 monthly over thirty years.

Sounds terrible, right? Wrong. You aren’t paying for it. In-fact, you are actually getting more money out of it. Let’s see the results for scenario 2:

- Property Price: $800,000

- Number of Units: 16

- Each Unit Rent: $750

- Total Monthly Rent: $12,000

- Mortgage: $2,661

- Expenses: $4,000

- Monthly Cash Flow: $5,339

You will be bringing home over 2.5x the amount of free cash flow (after the mortgage and expenses), and your asset will be worth over 4x more if you every wanted to sell!

This is the beauty of leverage. This is what brings scalability into play. The ability to grow your investments more and more overtime. Leverage gets it done a lot more efficiently, and a lot faster. You have access to a ceiling never thought possible, prior to learning about leverage.

This is why leverage is so popular among the top moguls like Donald Trump, Robert Kiyosaki, and Grant Cardone.

Leveraging Good Debt | Step-By-Step

1. Find The Deal

Grant Cardone says in his book, How to Create Wealth Investing in Real Estate, “People think it’s easy getting into real estate but it’s not. It takes reading report after report. You have to find a deal and that’s harder than people think.” Many people agree with his statement. Grant goes on to say that finding a deal is the hardest part of the real estate investing process.

2. Analyze the Deal

Brandon Turner, another multi-millionaire who made his fortune in real estate investing, explains how to analyze a deal in his book on Rental Property Investing. He says “you can’t just look at the rental income of a property and assume it’s a good deal. You forgot to factor in the other expenses:

- Taxes

- Insurance

- Flood Insurance (if needed)

- Vacancy

- Repairs

- Capital Expenditures

- Water

- Sewer

- Garbage

- Gas

- Electricity

- HOA Fees (if needed)

- Snow Removal

- Lawn Care

- Property Management

- and more.”

It’s a lot of expenses! That’s why it’s important to measure cash flow AFTER the expenses.

Cash Flow Formula

Income – Expenses = Cash Flow.

Simple enough, true enough. You take your overall income, subtract the expenses from the income, and what is left is your free cash flow.

3. Finance The Deal

Financing is the most important part of leveraging the deal— it’s where the leveraging actually happens. You need to decide if you are leveraging good debt or bad debt, and it all depends on the interest rate.

Interest rate: The amount a lender charges to let a borrower borrow a lump sum of capital.

If you have an interest rate that exceeds the positive cash flow, then you are leveraging bad debt. If you have an interest rate above where you feel confident, you are leveraging bad debt. Never willingly leverage bad debt.

4. Manage The Deal

It is suggested by many top investors that you should never manage your own properties. Don’t manage it, don’t have a family member manage it, find a great professional manager for your property. Don’t skimp out and pay too cheap, management is one of the most important things for a real estate investor.

Management takes all of your time, and sucks all of your energy away from finding the best deals you can.

Leveraging Bad Debt | Is it Possible?

It absolutely is! Bad debt is consumer debt that doesn’t pay you back. There are some things you can do to make this debt pay you back— though not ideal, it is still a way to make profit off of the debt.

Car Loan

If you have a new vehicle that is sucking down your money, put your pride to the side and sell your car. If it doesn’t make much financial sense in your situation, then rent it out! Buy a cheap $3k car, and rent out the fancy one. People will certainly lease your vehicle, as long as you provide a cheaper price than the dealer. You won’t make all of your money back, but you can continue to rent it once the payment is finished

You can rent out the same vehicle for years and years, however, the rent will depreciate as the value of the vehicle does.

Single-Family Mortgage

If you don’t have a large family, and you haven’t yet attained financial freedom, you shouldn’t own a home. Take out a loan, and buy a multifamily property. It doesn’t have to be expensive, but buy one. Preferably a triplex or quadplex. While you live in one of the units, rent the other 2 or 3 out. Not only will their rents cover the mortgage, it will provide you with a little bit of positive cash flow as well. A step-by-step to this is provided:

- Find the Property

- Pull Equity Out of Your Home For a Loan

- Move Into the Multifamily, Rent Out Your House

- Collect Rent – Pay Mortgage and Expenses

Find The Property

You shouldn’t rush into a bad deal. Find a triplex or quadplex that is a good deal, and then start making your financing moves.

Pull Equity Out of Your Home For a Loan

This is generally advised against, especially by the Dave Ramsey cult. However, that is because most people pull equity out of their home for a bad investment, or to blow on a vacation, a new car, or some other form of consumer debt.

If you pull the equity out of the home you’re living in, you can more than afford the down payment on a triplex or quadplex. How will you cover the two loans you have to pay? Continue through the steps.

Move Into The Multifamily, Rent Out Your House

While you were living in your house, your house was a liability. The moment you rented it out to a tenant, it became an asset. Because now it is paying you!

You now have to pay back your house, and you have to pay off the multifamily. How do you do that?

Collect Rent – Pay Mortgage and Expenses

Essentially, you will collect rent from the multifamily, pay the mortgage for multifamily using said rent. Collect rent from house, pay the mortgage using said rent.

This is not an unrealistic scenario, people use this strategy all the time. It is called house hacking. You essentially get two free properties.

Preventing Over-Leveraging

Over-leveraging is when you have accumulated too much debt, and you cannot safely pay all of it consistently. The moment there is a market downturn your entire portfolio could come crashing down when tenants cannot pay their rent.

So, how do you prevent this? There are a few things to consider before purchasing a deal:

- Don’t allow the financing to cloud your judgement

- Ensure there is more cash flow than expenses

- Keep a cash reserve at all times

- Relying on appreciation in order to make a profit

- Never have a deal with more than 75% debt

- Never neglect your properties, keep your tenants happy

- Avoid “ifs” when buying a deal. Think worst-case scenario

- Always have a plan for when (not if) the market tanks

- Have an exit strategy

Don’t Allow the Financing to Cloud your Judgement

Many deals end up making people go broke because of clouded judgement. They see a deal that is “just too good to pass up!” So they rush into the deal, thinking that they may never see a deal like that again.

Or we can talk about the other financing problems: Simply looking at how good the financing looks and overlooking problems in the property. If the deal isn’t worth it, it isn’t worth it, and financing won’t fix it.

Ensure there is more cash flow than expenses

If the rent doesn’t cover the mortgage and expenses, the deal isn’t good. You shouldn’t be paying out of your pocket for the typical monthly expenses and mortgage. If you are, then you lack scalability and will be stuck with the few units you are able to purchase.

Keep a cash reserve at all times

Ensure that you have enough cash to cover the mortgage and expenses for at least 3-6 months for each rental property you own.

This may seem conservative, but many people lose when they don’t do this. Your monthly cash flow should already net you positive. Take the positive cash flow, and save it until you have enough to set as a cash reserve. If your property is only netting you $100 monthly, you aren’t doing it right.

Relying on Appreciation in Order to Make a Profit

Appreciation is an amazing way to grow your real estate portfolio. Imagine you grow your portfolio to $10,000,000. If your property values go up a measly 5% in one year, then you just made $500,000!

The problem is when you rely on appreciation. Rental appreciation doesn’t make your payments! Rental cash flow does. Cash flow is the lifeblood of your real estate portfolio.

Never Have a Deal With More Than 75% Debt

Most of the stories about failed real estate ventures involve deals with over 80% debt. These are very risky deals and should be avoided if you care about your financial safety. This is stressed by the greats— even some of the greats made this mistake, and it costed them.

Never Neglect Your Properties, Keep the Tenants Happy

When you neglect what the tenant wants, (within reason) you accept the fact that the tenant will most likely leave. You are also adopting a habit of not maintaining your properties, which leads to things not working a lot more often, leading to more money being spent in the long run.

All of these problems that start adding up can lead to you going bankrupt.

So please, just be a good landlord and take care of your tenants.

Avoid “Ifs” When Buying a Deal. Think Worst-Case Scenario

Don’t try and stretch the truth so that a property seems like a good deal when in actuality, it isn’t. Don’t fool yourself. There will always be more deals out there. Don’t be afraid to say no. It is better to say no in most cases than to say yes.

Grant Cardone says for every deal he makes, he says no to hundreds. Donald Trump says some of the best investment advice he’s ever heard is to say no.

Maybe you should say no sometimes as well?

Have a Plan for When (Not If) the Market Tanks

The market will tank.

Let me repeat this.

The market will tank.

You need to have a plan for it. None of us know when or how it is going to happen. None of us will be able to form an exact plan on how to react to it, things happen. But you need a plan on what to do in certain situations, and then when the market does tank, carry out a plan of action similar to the plans you’ve already written down.

Have an Exit Strategy

You need to have a plan to sell. Even if you don’t intend on selling, the opportunity may arise where it is the best option for you to take in that moment.

Every successful real estate investor has exit strategies for all of their properties, and it is important that you adopt these techniques as well.

Is All Debt Bad? | Leveraging Good Debt and Bad Debt

This brings us to the final question: Is all debt bad? There are some investors who firmly believe that all debt is bad.

But they’re not at the top either, now are they?

This article has shown the difference between good debt and bad debt, and that good debt and bad debt are actual terms in the field of business.

Leverage is not necessary for you to perform decently at real estate, but if you want to climb to the top, leverage is an essential tool that must be utilized to get there.

Thank you for reading my article, “Is All Debt Bad? | Leveraging Good Debt and Bad Debt” and if you have any questions or suggestions, leave a comment below or email me personally at alex@rentalsandrealtors.com

Wow, what a usefull information, very accurate and professional. Everyone who intend to become a real state entrepenuer need to check this web site and follow you. Great Job mate.

This is a very complicated topic to us the public, in terms of making the decision on prioritization. Thanks to your post it is very informative and helps in having a batter understanding of types of debts more specially bad debt. The post came at a very crucial times where the whole world is faced with economic meltdown due to the “pandemic”. More people including companies are in financial constrains from different aspect of life.