Are REITs a good investment? Why wouldn’t you just invest in a rental property?

- Time

- Passive Income

- Less Risk

- Diversification

If we ask ourselves a question like “are REITs a good investment”, we have to look at our own personal goals. What is good for one investor may not be good for another. In this article, I’ll give you some points to help you in this decision, but it is ultimately a decision you will need to make by the end.

REITs, or Real Estate Investment Trusts, are companies that either own, operate, or finance income-producing real estate properties across a scope of sectors. There are many requirements that these companies must meet to be classified as a REIT, so they are in a unique class.

What are the Requirements to become a REIT?

The requirements to be classified as a REIT vary from country to country. In the United States, a company has to:

- Have at least 75% of its total assets invested in real estate

- Structured as a corporation, trust, or association

- Managed by a board of directors or trustees

- Pay dividends of at least 90% of the REIT’s taxable income

- Have transferable shares or transferable certificates of interest.

- Otherwise be taxable as a domestic corporation

- Jointly owned by 100 persons or more

- Have 95 percent of its income derived from dividends, interest, and property income

- Cannot be a financial institution or an insurance company

- Have no more than 50% of the shares held by five or fewer individuals during the last half of each taxable year (5/50 rule)

- Derive at least 75% of its gross income from rents or mortgage interest

- Have no more than 25% of its assets invested in taxable REIT subsidiaries.

REITs are held by strict guidelines, so you can be assured that you will be paid consistently, and for a long period of time, as long as you invest in a good company.

Are REITs a good investment? To answer a question this broad, we’ll go through the pros and cons of investing in REITs, and then we will compare two different scenarios to see who would benefit from this type of investing.

So, let’s discuss the pros of investing in a Real Estate Investment Trust:

- Less Hassle versus Physical Real Estate

- Higher Returns versus Stocks

- Safer Insurance versus Commodities

- No Minimum Amount Required

- Completely Passive Income

- Higher Liquidity versus Physical Real Estate

- Mandatory Distributions versus Dividend Stocks

Less Hassle versus Physical Real Estate

When you invest in a REIT, you own a piece of a Real Estate company, and the properties they own. It is similar to investing in a company like Cardone Capital. Whatever properties they choose to invest in, you will get a portion of the rent. Whether the REIT chooses to pay monthly or quarterly is entirely up to them.

Obviously one of the biggest downsides of investing in real estate is the hassle involved with finding the deals, signing paperwork, renovating, maintaining the property, finding quality tenants, and dealing with the volatility of the market.

When you invest in a REIT, all of the hassle is gone. You simply go on the stock exchange, find a REIT you like, and click “Buy”. You now own pieces of a realty company! You will get a check periodically with your cut of the rent, and assuming the REIT performs positively, you will be able to sell at any time at a gain.

REITs allow for a much more pleasant experience than physical real estate.

Higher Returns versus Individual Stocks

Obviously, if you found a company like Amazon when they were young, or a company like Netflix when they were young, this would be completely wrong.

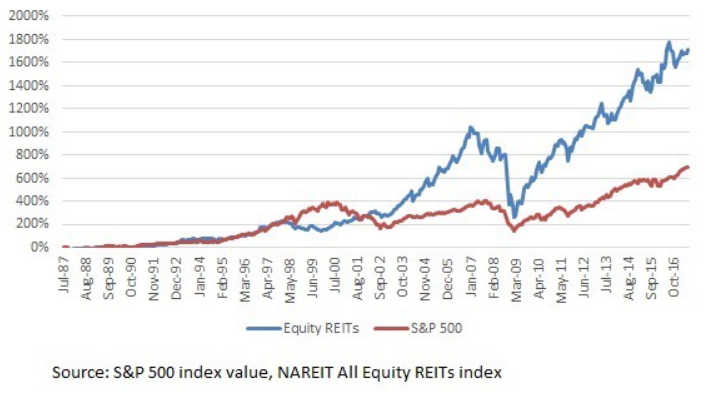

But let’s compare the average annual returns of the NAREIT All Equity REIT Index versus the S&P 500 Index.

Typically, stocks rely on capital appreciation, which is a volatile method of investing. You never know what is going to happen. Yes, there are companies who focus more on dividends, but dividend investing isn’t the typical approach to the stock market.

REITs are required to pay 90% of their profits to their shareholders, making returns practically guaranteed. The main times that REITs suffer is during a housing market crash— where stocks also suffer.

Stocks typically have capital appreciation, with minor dividends, if any. REITs typically have large dividends, decent dividend growth, with minor capital appreciation. When an investor reinvests the dividends paid towards them, then the REIT portfolio grows larger and larger, while the stock portfolio relies on the same number of shares it started with.

Safer Insurance versus Commodities

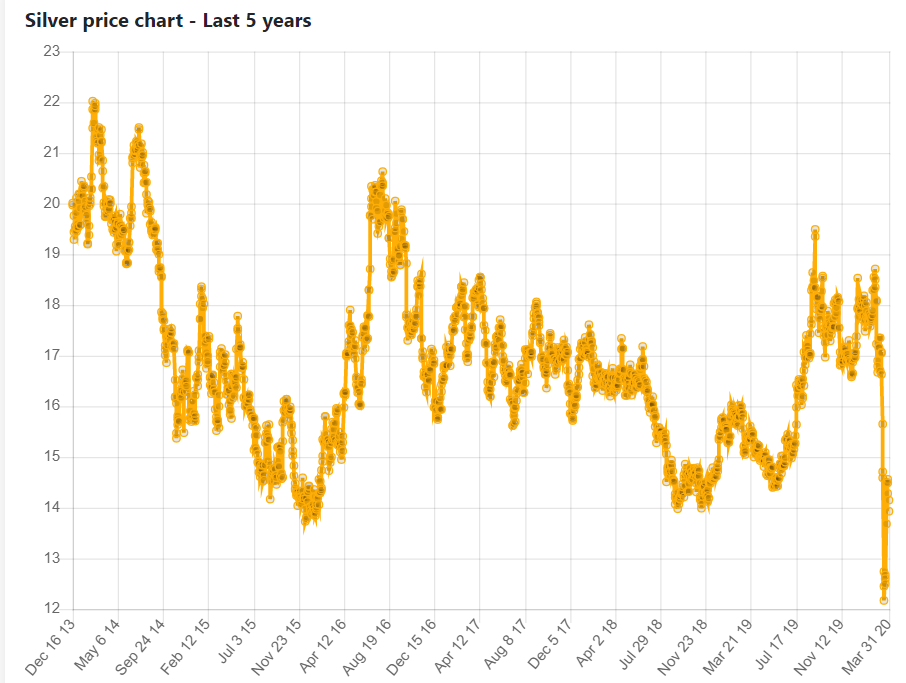

Commodities are things like crude oil, gasoline, cattle, and precious metals. Many people invest in them as a hedge against recessions and market downturns. But is that really such a good idea?

I am not saying investing in commodities is bad. I personally invested in crude oil companies when I saw great deals on the market. But is oil a good long-term investment compared to REITs? I would say no.

People invest in commodities for safety, but just recently, the price of oil plummeted last month because of the actions that ONE country made.

Let’s view the historical price of crude oil:

If you would have invested in oil thirty years ago, you would have gained nothing. You would have lost money. Oil is a good short to mid-term investment, but it is not good long-term. Imagine holding a commodity for THIRTY YEARS and making NOTHING.

Or you could have invested in silver during the largest bull market of all time. You could have made a killing in stocks, or REITs, or physical real estate. If you would have invested in silver, you would be at a loss.

As was said earlier, many people invest in commodities to hedge against recession, but many times, they aren’t any safer than a stock or a REIT.

No Minimum Amount Required

Many people want to invest in real estate. When you mention real estate investing, what is the first thing they think of? Probably buying properties to rent out to tenants. Or flipping properties. Or wholesaling. But all of these strategies have one thing in common:

They all require capital to start.

If you don’t have $20,000 to pay a down payment on a $100,000 property, then there’s a good chance you won’t be able to purchase it.

However, if you have $20, you can buy 2 shares of a REIT worth $10, and be set on your investing journey! Granted, the returns won’t be very impressive with a $20 investment, but it is certainly better than no return at all!

When you start investing in REITs, and consistently put a portion of your money into your portfolio while reinvesting all of the dividends you receive from your REITs, your income won’t add. It will multiply. It is compound interest at it’s finest, which Albert Einstein called the “8th wonder of the world”. You can build a massive, 6, 7-figure portfolio with a small starting investment.

Completely Passive Income

What is the biggest difference between the rich and the poor?

“A wealthy person is simply someone who has learned how to make money when they’re not working.” -Robert Kiyosaki

When you invest in something like gold, you have a hunk of metal that is worth whatever price someone is willing to pay for it. It does nothing to benefit you while it is in your possession. Only when you sell, will you make a profit.

When you invest in a stock like Amazon, it does nothing for you while you are invested in it. They do not pay a dividend like a REIT does.

When you invest in a REIT, you get passive income. Passive income is the single-most important concept that you need to become wealthy. Do you ever wonder why you never see doctors or lawyers as the world’s richest? You often see investors, real estate owners, people that receive passive income.

I have family members that are over 70 years old, and they’re still struggling to make it. They are working 6 days a week, all day. They don’t have any passive income, and that is a problem for a lot of people. “If you don’t find a way to make money while you sleep, you will work until you die.”

So are REITs a good investment? If my family member would have invested in REITs 30, 40, or even 50 years ago, it would have made drastic changes to their quality of life.

A REIT Investment Provides Higher Liquidity

When you want money fast— whether it’s for a deal, investing opportunity, or you simply need money, REITs are much simpler to turn into cash versus something like physical real estate.

With physical real estate, you have to run through all of the paperwork of putting your property on the market, waiting for a buyer, and then going through all of the paperwork of selling. And you will more than likely be getting a bad deal if you care more about speed versus value.

When you want to sell a REIT, simply go to your online broker, log in, click “Sell”, confirm, and boom, your shares will be sold in a matter of seconds, and your money will be transferred to your brokerage account. When it comes to liquidity and simplicity, REITs definitely win over physical real estate.

Mandatory Distributions

Unlike normal dividend stocks, REITs have mandatory distributions. As stated previously, they must pay at least 90% of their profits to shareholders. This means that either every month or quarter, you will receive a payment!

Let’s compare this to companies like Boeing, or General Electric. Companies like these were at the top of their industry. Many still think Boeing is at the top of their field, and I’m not going to argue that point.

General Electric had some management issues, and cut their dividend to $.01. Boeing had some management issues and cut their dividend completely.

REITs will either pay you a dividend, or they won’t be a REIT anymore. There are no exceptions. If you find a strong REIT to invest in, you will be receiving a consistent payment as long as you remain invested with them.

Cons for REIT Investing

There is no “perfect investment”. Each investment has their pros and cons. If there was an investment vehicle that ruled over the others without question, then there wouldn’t be other popular investment vehicles available.

We’ll discuss the cons of Real Estate Investment Trusts in this section:

- Taxes on Dividends

- Limited Capital Appreciation and Compound Interest Potential

- Sensitivity to Interest Rates

There aren’t many cons for REIT investing, but they are fairly large downfalls. I’ll explain down below:

Taxes on Dividends

Most dividend stocks, such as Johnson and Johnson or Coca-Cola, who are considered qualified dividends. In order to be considered a qualified dividend, a company must meet the two following requirements:

- Must be issued by a U.S. corporation, or by a foreign corporation that readily trades on a major U.S. exchange, or by a corporation incorporated in a U.S. possession.

- The shares must have been owned by you for more than 60 days of the “holding period” — which is defined as the 121-day period that begins 60 days before the ex-dividend date, or the day on which the stock trades without the dividend priced in. -Motley Fool

Most REITs are not considered qualified dividends, which essentially means you will be paying the normal income tax-rate on all dividends you receive. Qualified dividends give you a pretty hefty tax discount.

If you would ordinarily pay 15% or less on taxes, you would pay nothing in taxes with qualified dividends. The discounts go on from there the further you go up.

This is obviously a huge drawback when investing in REITs, and is something you should consider when making your investing decisions.

Limited Capital Appreciation and Compound Potential

I spoke about compound interest earlier in the article, and yes you can still compound REITs effectively. Especially when we are talking about normal stocks or commodities, you can certainly compound REITs efficiently.

However, when you compare REITs to the compound potential of physical real estate, there is no question: Rental Properties win, everytime.

You can purchase 5x the assets with one loan. If you spend $100,000, you can receive $500,000 in return. Obviously, you have to pay it back with interest, or do you? This is where the BRRR method comes in. If you have a tenant in the units paying the mortgage, are you really paying for it at all? And if the rent is more than the mortgage, (it almost always is) then you are getting positive cash flow and you aren’t even having to pay for the mortgage!

Once you expand your physical real estate portfolio, the compounding effects starts showing more and more as you collect more and more checks from your tenants.

REITs provide you with good compounding potential, but they can’t compare to collecting 100% of the rental check. Now remember, collecting 100% of the check comes with A LOT of risk. Risk that has sent many people to the bank to declare bankruptcy.

If you want to avoid the risk, REITs are certainly the safer play.

Sensitivity to Interest Rates

Real estate in general is very sensitive to interest rates, and REITs are no exception. When interest rates rise, REIT performance typically lowers. When interest rates lower, REIT performance typically rises.

In the long-term, REIT performance rises even if the interest rates remain the same, but as you can see, REITs follow the interest rates through short-term fluctuations.

Comparisons

This entire article has been about providing you, the reader, with the information to decide for yourself if REITs are a good investment, or if another investment vehicle is right for you.

If someone purchased a rental property without knowing what they’re looking at, there is a lot of money to be lost. If the property is not in as good shape as they thought, then they could actually lose money trying to get it ready for a tenant. Depending on how much the owner makes, they might not be able to pay the extra mortgage + renovation.

They could spend YEARS paying off the property while saving the funds to finish the renovation. If you asked them after everything was said and done— “are REITs a Good Investment?” They would probably have told you yes. Because instead of spending years losing money, they could have been compounding their investment and profiting overtime.

On the other side of the coin, you could have a carpenter who decides that they’re too busy to invest in a rental property, so he invests in a REIT instead. He already knows what a property should look like, he knows how to work on it, and he can somewhat gauge the costs of renovation. He is the perfect person to invest in a rental property!

He didn’t make a bad decision investing in REITs, but he certainly gave up opportunity cost, because his profits are much lower investing in REITs than if he had pursued rental properties. So if you asked the carpenter when all was said and done, “are REITs a good investment?” He probably would have told you to find something more profitable.

This brings us to the main point of the article:

Are REITs a Good Investment?

I can’t answer this question. The question I believe I’ve answered is that REITs have the potential to be good investments. As an investor, you have to evaluate your goals and decide through research, if investing in REITs is the right move for your portfolio.

This article came at almost perfect timing. I recently began investing in preforeclosures which naturally led me to REIT. You gave me a lot of helpful insight. Thanks and a good article.

You’re very welcome! And good news for you, there will be many posts about foreclosures in the near future! That’s actually what our realty company is bidding on now!

Very informative article! I never knew exactly what an REIT was, and I certainly didn’t know that they were required to pay a percentage of profit in dividends. I will definitely have to look into this further. Any specific REITs that you think I should research?

Glad you enjoyed the article!

Realty Income (Ticker Symbol O) is widely considered one of the greatest REITs on the market. Their slogan is “The Monthly Dividend Company”, meaning they are known for paying dividends every month instead of every quarter. They are a Dividend Aristocrat as well, meaning that not only have they paid a dividend for over 25 years, they’ve increased the payment consecutively every year for at least 25 years.

Some other REITs to look into are LTC Properties, Gladstone Capital, EPR Properties, and Main Street Capital.

Hi, your site is really very interesting. REIT, I had never heard of it. Now that I have read the whole article I see it really full of information.

I did not know anything at all about a REIT before reading this article, but it helps clarify things a fair bit. A few years ago I experimented with a virtual account on a website that traded in a similar sort of way, but never had the courage to sign up for a real account in case I lost too much money.

I think I might have seen something like this on Shark Tank. It’s an interesting idea and with mortgage rates low this might be the time to look deeper into REITs.